Hello Everyone… Seems like it has been forever since I have posted.

A lot of changes for Myself and my team that has made this a bit crazier month.. and school started!! Can every Mama say “AMEN”. Getting back in the swing of school can be a bit overwhelming but yet so exciting at the same time. I wanted to take a quick moment on a question I get asked ALOT!! ” Can I get a manufactured home”?

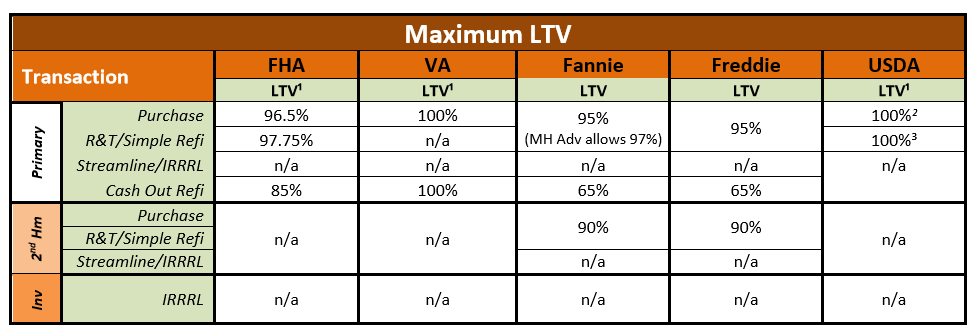

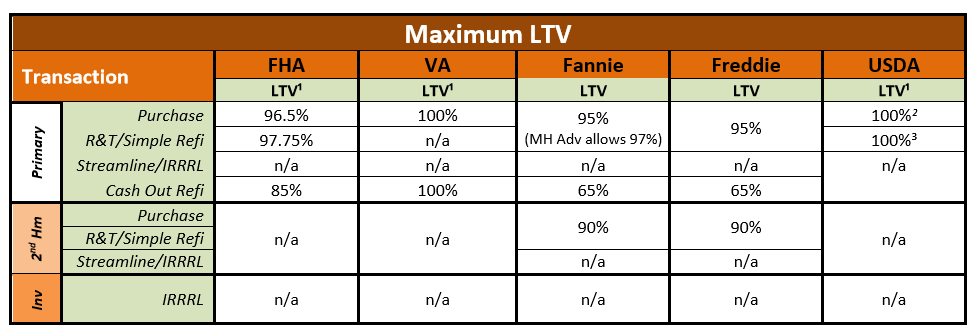

I know a lot of lenders try to defer clients from a mobile/manufactured home due to them not having that product available. But it is defiantly an option that is available for many loan programs. I have attached the program matrix below. As you can see for VA loans, you can get 100% financing, you can also do a cash out refinance if you own your home at 100% LTV. With FHA , there is no difference in LTV , it is the regular 96.5 ( 3.5% down). Conventional is a little different when it comes to a refinance, but it is still a doable option for most. It can still be purchased as a 2nd home for conventional. ( It can not be an investment property) . As far as credit scores, it isn’t different then buying a single family dwelling. But some lenders have overlays, so that is a question to ask your lender.

Each product has its rules and guidelines when it comes to set up and what is looked at during the loan process. It must be “real property” and has to be immobilized. Please see below on what lenders are looking for when doing a manufactured home. There can be rate adjustments for a manufactured home with some products… But not all. An extra inspection is needed with most programs. That is usually a structural engineer report. The ones that we come across can run anywhere between 350-600 dollars. So that is something to keep in mind.

As I always say” know your facts”. That will be an important key on finding your dream home and the lender that fits YOUR needs. Lenders have overlays that can be misinterpreted as guidelines. So it is so important not to get discouraged.

I hope I touched on questions that you may have. I wish everyone a Happy end to MONDAY and a great rest of the week.

Published by Heather Paige Moody

Welcome! I'm Heather ( AKA: Paige) Moody . A Little About me: I was born and raised in a small town in Eunice, Louisiana where I started my first mortgage company in 2005 at the age of 21 years old. Since 2005 I’ve grown to know everything when it comes to the industry, from owning a mortgage company, processing loans, mortgage underwriting rules, to now managing.

Why I’m in the Mortgage Business:

My family has a history of Banking and real estate . I could see at an early age how satisfying the real estate profession was for them, so I started off as a Real Estate agent and quickly realized that the mortgage side was my passion.

I am a mother of 4 very active kids that have been/ are being raised in the Real Estate /mortgage world. I have always said that their first baby blanket was a file folder.

I love to be able to teach that going the extra mile for others is such a blessing to us as well as the other person. Most importantly that no matter what the obstacle is that we must work hard and give it our all in all that we do. Our family lives at a field or a gym for most of the year. Between baseball, cheer, volleyball, football and anything they can possibly sing up for, I have developed little-known disease called Bleacher Butt.

When I am not working ( or should I say.. not behind my desk) or attending an event for one of the kids . I really enjoy bible studies , reading and listening to podcast. My children go to 2 different schools and I am so blessed to be part of two Mom’s in Prayer groups. It is a National Organization that Moms can get together to pray for our children and our school.

As the Southern Mortgage Mom, I help homebuyers and Real Estate Agents make the Mortgage buying process as stress free as possible. I have been called the miracle worker by clients and agents( on occasion) because I have saved some mortgage loans that others have denied . It has nothing to do with miracles , but all to do with knowing how to get a loan approved.

If I am lucky enough that you chose me or my team as your go to lender, I promise that I will be fair, I will be honest and you will feel like family when you sign the final papers and I will keep in touch (till you tell me not to) long after the mortgage loan is closed. Looking forward to working with you when it comes time to buy a home or refinance your current mortgage.

View all posts by Heather Paige Moody